Digital Enclosure and Unfreedom in Northwest China

May 6, 2021

11:25 am

Darren Byler, University of Washington, discusses the working paper "Digital Enclosure and Unfreedom in Northwest China."

The author will join for a conversation about their work. No formal presentation will be given; please read in advance. A link to the reading will be sent with the registration confirmation.

Part of the Reppy Institute for Peace and Conflict Studies (PACS) seminar series.

Co-sponsored by the Departments of Anthropology and Science & Technology Studies (STS).

About the author

Darren Byler is a postdoctoral researcher in the ChinaMade project at the University of Colorado, Boulder. He received his PhD from the Department of Anthropology at the University of Washington in 2018. His research focuses on Uyghur dispossession, infrastructural power and "terror capitalism" in the city of Ürümchi, the capital of Chinese Central Asia (Xinjiang). He has published research articles in the Asia-Pacific Journal, Contemporary Islam, Central Asian Survey, the Journal of Chinese Contemporary Art and contributed essays to volumes on ethnography of Islam in China, transnational Chinese cinema and travel and representation. He has provided expert testimony on Uyghur human rights issues before the Canadian House of Commons and writes a regular column on these issues for SupChina. In addition, he has published Uyghur-English literary translations (with Mutellip Enwer) in Guernica and Paper Republic. He also writes and curates the digital humanities art and politics repository The Art of Life in Chinese Central Asia, which is hosted at livingotherwise.com.

About the working paper

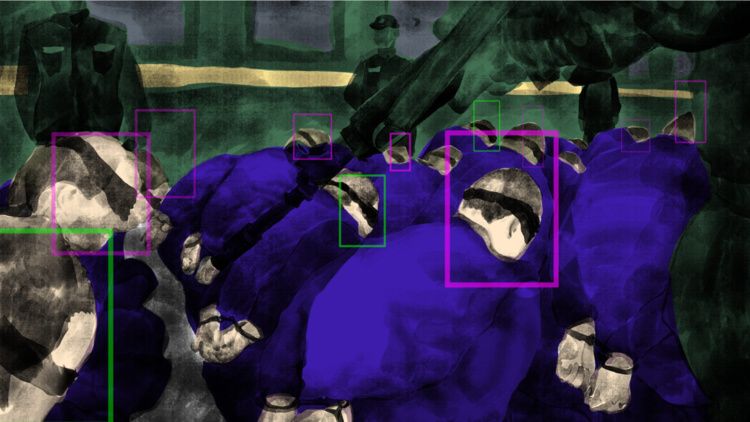

The author explains: "In my work I use the conceptual framing of a digital enclosure to consider the way Uyghur and Kazakh societies in Northwest China have been enveloped by a surveillance system over the past decade. I show how novel enclosures are produced and, in turn, construct new frontiers in capital accumulation and state power. The Turkic Muslim digital enclosure system gives technology companies and state authorities abilities to watch and control the movements and behavior of Muslims in increasingly intimate ways, turning them into an unfree proletariat--a docile yet productive permanent underclass."

Artwork by the artist Badiucao. Used with permission.

Additional Information

Program

Mario Einaudi Center for International Studies

Reppy Institute for Peace and Conflict Studies

East Asia Program